Morgan Look acceptance silver to average $3,675 per oz because of the last one-fourth from 2025 and you may potentially climb up for the $cuatro,one hundred thousand for each oz by the mid-2026. Goldman Sachs also programs silver you are going to arrived at $step three,700 from the 12 months-stop 2025. Key catalysts tend to be expected dovish economic rules regarding the You.S. Federal Set-aside, and that usually decreases the chance cost of holding low-producing property, chronic geopolitical tensions driving secure-sanctuary consult, possible You.S. money weakness, and ongoing concerns about rising prices. Such points are required to produce a working market with tactical financing possibilities in the course of prospective short-term volatility.

Silver traders to stay focused on governmental and you can geopolitical statements

- To the Monday, gold generated an alternative closure high, its highest daily close-in history.

- Gold’s seated near peak membership following a continual rally one to’s survived over a year.

- Even though some high buyers provides inserted the market, Bitcoin lacks silver’s long records as the a secure refuge during the times of crisis.

- Presenting a new step three×step three style and you can gold exploration motif, Silver Rally demands professionals to help you win large having icons such as dynamite, silver bars, and you can bills.

Since the an economist planned, Eren Sengezer specializes in the fresh analysis of your small-term and you can enough time-label affects out of macroeconomic study, main lender principles and you can governmental improvements to your monetary possessions. The fresh graph less than highlights the difference between put Silver costs (bluish line) as well as the COMEX Futures cost (red-colored line). President Donald Trump’s tariff rules, that could push inflation and you can spark trading conflicts. For the Saturday, Trump bought an excellent probe for the prospective the brand new tariffs to your copper imports, contributing to suspicion. If you are inflation concerns typically service silver as the a safe-retreat investment, highest U.S. Treasury production and you can a stronger dollar is capping growth to your Wednesday.

Buyers also needs to on their own think if the ESG funding unit fits her ESG expectations or requirements. There isn’t any warranty one to a keen ESG using means or techniques working will be winning. Earlier performance isn’t a vow otherwise a reliable measure of upcoming results. When rates rise, thread cost slide; usually the prolonged a good bond’s readiness, the greater painful and sensitive it’s to that particular risk. Securities can also be at the mercy of phone call risk, the chance your issuer often get the debt during the its alternative, fully or partly, until the booked maturity go out.

Central banking institutions are also likely to remain contributing to their holdings, that ought to provide service. So it means an almost 20% acquire merely a https://happy-gambler.com/secret-of-christmas/ handful of days to the year. Gold’s excellent performance was even sufficient to outpace the brand new S&P 500 inside Q1. The good Market meltdown is actually the final go out silver pulled just before the market, underscoring the fresh desperation away from latest economic climates since the traders seek a means to include its wealth. For people, gold represents permanence and you can financing maintenance; silver now offers better short-term opportunity.

Prevent away from Thread Bull Business Sets off Need for Difficult Assets

Central banking institutions trying to diversify the international supplies features buoyed gold’s well worth. Broadening main bank purchases, decreasing rates, and you can increased geopolitical stress have created a great “prime violent storm for gold,” ING manufactured in a recently available research note. Possibly highway erodes believe inside report possessions, reinforcing Schiff’s part one to people may begin so you can tough assets including silver and you will gold coins because the have confidence in Us fiscal government is out. Of numerous analysts is comparing the present day economic climate to this away from the newest 1970s until the savings registered almost a decade from corrosive stagflation.

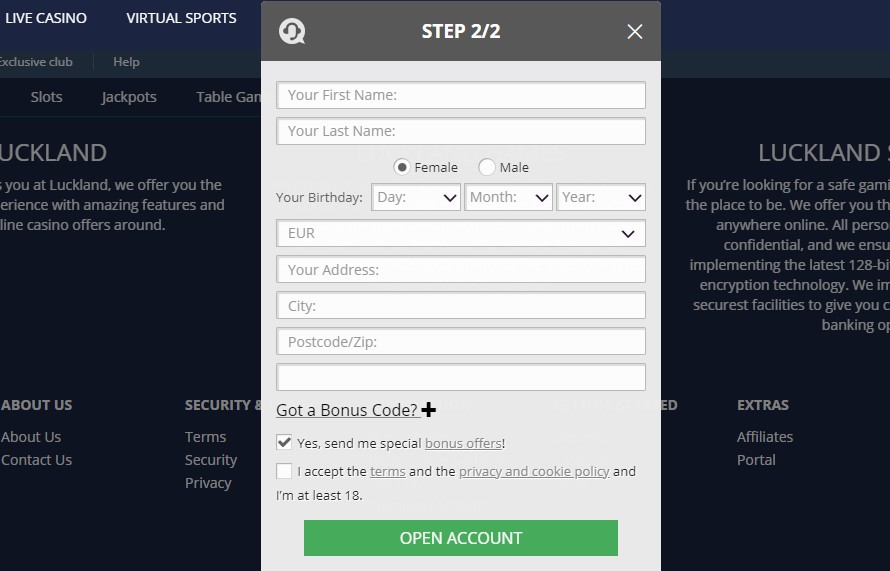

Gambling establishment Bonuses

“Gold is often named a great hedge up against suspicion, however the hedge might be unwound.” “The new rally we come across this week … is actually part of the things i manage phone call the brand new ‘focus on it sensuous’ exchange,” Rodda told Al Jazeera. Subscribe a large number of smart people which discovered pro study, market reputation, and you will personal sale every week. He or she is found to own illustrative intentions simply plus don’t represent the brand new performance of any certain investment. The new indices are not subject to expenditures otherwise costs and they are usually comprised of bonds or other financing devices the brand new exchangeability of that’s not minimal. A specific funding equipment will get add securities significantly distinct from those in people index referred to here.

To the right of one’s grid, you’ll come across three males driving an excellent coal cart from caves, their term alternatively demented and scared while they hurtle to the darkness. Above her or him, you can find tabs appearing their Wager, Borrowing from the bank, Earn and Line Wager, and below the grid by itself your’ll see buttons to own Spin, Choice You to definitely, Bet Max and Paytable. Historically we’ve gathered relationships on the websites’s top slot video game developers, therefore if another online game is going to miss they’s almost certainly we’ll learn about it very first.

Bitcoin Anxiety Index Strikes Annual Low, Bitwise Notices To find Options

But not, the fresh relief appears small-existed, which have larger geopolitical threats and you will unresolved European union-United states exchange talks remaining investor sentiment protective. Away from October ten to 26, customers paying Dhs500 or even more in the gold, jewelry, to see places is also enter an excellent raffle so you can earn gold coins and you may bars, having a couple of champions chosen each week. Eric Sepanek ‘s the inventor away from Scottsdale Bullion & Coin, created in 2011. Which have thorough experience with the new gold and silver coins world, he’s serious about teaching Americans to your wealth conservation strength of gold-and-silver. Sean Brodrick songs the new fast-rising arena of precious metals and you may critical vitamins that are reshaping global have organizations. Their fieldwork, sharp field perception and capacity to spot higher-profit-potential options render Weiss Analysis customers a benefit — well before Wall structure Highway grabs on the.

Governmental And Monetary Uncertainty Push Demand

Precious metals have taken cardio phase inside the worldwide places, which have gold recently exceeding $cuatro,one hundred for each and every ounce and you can silver climbing over $51, marking the highest profile to the checklist. Which surge features grabbed individual focus international, underscoring the fresh revived need for real possessions in the midst of rising economic uncertainty. Information what’s fueling it gold and silver rate rally is very important to own buyers trying to navigate a volatile community. Away from Federal Set aside coverage changes for the come back out of inflation and you can an upswing out of main bank demand, here you will find the five core pushes propelling silver and gold large inside the 2025 — and just why they count for long-label portfolios. Closely screen significant main financial financial plan decisions, for example on the U.S. Government Set-aside, away from interest levels, as the dovish changes often like silver.

Gold News: Profit-Getting Stalls Rally In the course of Tariff Suspicion since the PCE Analysis Looms

If you’d like to winnings the brand new modern jackpot, you ought to wager during the limit risk. Once you have decided on the share, you can activate the new AutoPlay mode so that the newest reels so you can twist by themselves for up to 99 revolves otherwise until you trigger the new Silver Rally Bonus setting. Record suggests all of us you to gold will go up if the stock exchange decreases. Section of this can be concern you to definitely mutual tariff hikes have a tendency to kick worldwide economic growth in one’s teeth.

Silver is just about to break over $4,150 and you can gold is just about to split over $53. But the main knowledge may be the global rug pull-on the brand new You.S. money and you will Treasury business. Gold and silver try breaking details, and you can seasoned economist Peter Schiff claims the fresh rally’s simply starting. His current warning shows a stormy visualize for the dollar, debt, and also the way forward for currency alone. Sobti extra which he anticipates see PSU surfaces on the electricity market to attract solid to buy supposed ahead in the course of the government’s relocate to speeds paying for indication, renewable power, etcetera. The new Indian stock market concluded somewhat higher for the Friday in the Muhurat change lesson, extending gains to your fifth successive lesson.

GoldRush Rally also provides a comprehensive directory of features designed to increase the experience to own participants within deluxe car rally feel. The brand new goldRush Rally Party would like to make sure you feel the finest feel when you invest with us. Starting from Boston and all sorts of the way to Boca Raton view your luggage inside to your GR Concierge Team members and it might possibly be in store on your own room when you are getting for the next destination.

Gold is additionally commonly thought to be a hedge up against inflation and you may facing depreciating currencies as it doesn’t rely on people certain issuer otherwise government. Its worth isn’t linked with people unmarried regulators or central financial, therefore it is a good hedge not merely up against rising cost of living plus up against geopolitical exposure and you can currency collapse. Whether your’re also in the usa, Europe, otherwise Asia, gold try a great universally recognized and you can trusted advantage. The new silver put price is determined out of silver futures deals to your the fresh Products Change (COMEX) to determine the price of silver today. Highest interest levels for extended do enhance the options cost of holding gold. VanEck’s GDX, the most significant gold miner ETF, provides sprang 28.8% year-to-go out, notably outperforming the newest S&P five hundred, which includes lost 4%.

The fresh monetary world try witnessing an unprecedented rise inside the main financial gold accumulation, a sensation that has sooner or later altered the brand new gold business surroundings. Immediately after years of being internet suppliers or carrying static supplies, central banking institutions has stopped direction considerably, getting voracious customers. So it to shop for spree provides seen annual central financial silver demand meet or exceed 1,100000 tonnes in recent years, a level not observed in half a century. The new development suggests zero signs of abating, having a striking 95% out of main financial institutions expecting worldwide gold supplies to improve along side next year, and an archive 43% earnestly likely to improve their very own holdings. Silver has an inverse correlation on the United states Dollars and United states Treasuries, which are each other biggest set aside and you may secure-haven possessions.